Bookkeeping and Accounting for Lumberjacks

Skilled laborers who specialize in extracting and processing wood and wood products are known as lumberjacks. They play a vital part in the forestry sector by falling trees, chopping them into logs, and moving them to sawmills or other processing facilities. Even though their jobs are physically demanding, lumberjacks nevertheless have to run their businesses profitably. Logging and accounting are essential for woodcutters to monitor their earnings, control spending, adhere to tax laws, and make wise business choices.

Accounts Junction offers customized solutions made especially for woodcutters. These solutions include tracking and classifying earnings and outlays, balancing bank accounts, preparing and submitting tax returns, creating financial statements, and guaranteeing adherence to legal and regulatory obligations. Lumberjacks can concentrate on their primary company operations and leave the financial management to the professionals by outsourcing their bookkeeping and accounting responsibilities to Accounts Junction. This will ensure the long-term success and sustainability of the business.

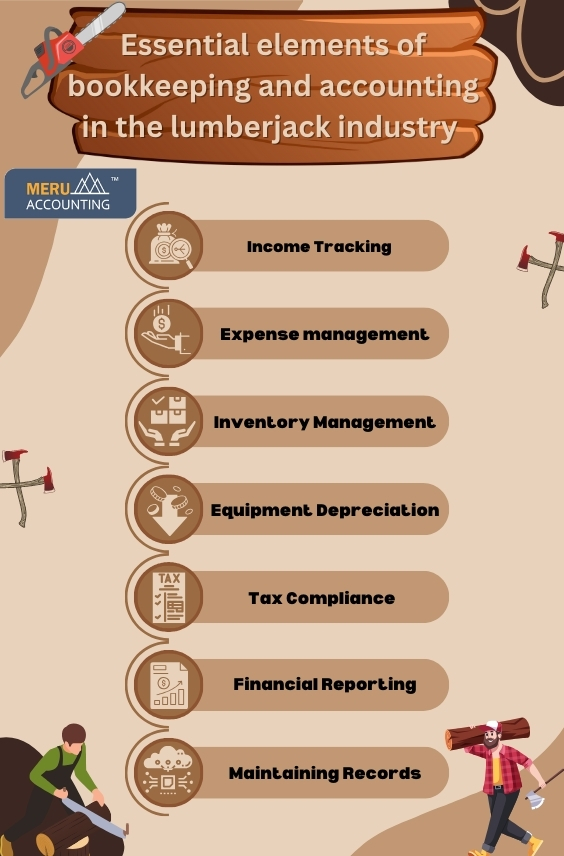

Essential elements of bookkeeping and accounting in the Lumberjack Industry

Accounting and bookkeeping are essential for overseeing financial transactions, monitoring resources, and guaranteeing regulatory compliance in the lumberjack sector. The following are the main facets of bookkeeping and accounting in the lumberjack sector:

-

Income Tracking: Lumberjacks get money from a variety of sources, including selling wood, doing logging work, and processing wood goods. Maintaining precise income tracking helps evaluate the business's financial performance by ensuring that all revenue is appropriately documented.

-

Expense management: Fuel, insurance, labor, permits, equipment upkeep, permits, and transportation are just a few of the many costs that lumberjacks must deal with. Monitoring these expenses, finding opportunities for cost optimization or reduction, and making sure that spending stays within financial limits are all necessary for effective expense management.

-

Inventory Management: Lumberjacks need to manage inventory levels of harvested timber and processed wood products. This includes tracking the quantity, quality, and value of inventory on hand, as well as monitoring stock levels to meet customer demand and minimize storage costs.

-

Equipment Depreciation: Lumberjacks rely heavily on specialized equipment such as chainsaws, trucks, skidders, and loaders. Accounting for equipment depreciation involves recognizing the decrease in value of these assets over time, which impacts profitability and tax liability.

5.Tax Compliance: At the municipal, state, and federal levels, lumberjacks are subject to a number of tax laws. This includes paying sales taxes due, completing tax reports, and abiding by the tax regulations pertaining to business income, payroll, and equipment depreciation.

6. Financial Reporting: The creation of financial reports, including cash flow, balance sheet, and profit and loss statements, offers important information on the state of the business company's finances. These reports help assess performance, identify trends, and make informed business decisions.

7. Maintaining Records: Maintaining accurate and organized financial records is essential for transparency, accountability, and audit readiness. Proper record-keeping ensures that all financial transactions are documented, archived, and easily accessible for reference or verification purposes.

What distinguishes accounting for lumberjacks from general accounting?

Although generic accounting concepts offer a basis that can be used by a multitude of businesses, accounting for lumberjacks involves certain subtleties and factors that are exclusive to the logging and forestry industry. The following are some significant distinctions between general accounting and accounting for woodcutters:

-

Job Costing: Typically, lumberjacks work on distinct forestry or logging projects, each with their own expenses and earnings. In order to precisely estimate project profitability and assign costs, job costing entails keeping track of the direct and indirect costs related to each project, such as labor, equipment utilisation, supplies, and overhead.

-

Equipment Depreciation: Chainsaws, skidders, loaders, and trucks are just a few examples of the specialized tools and machinery that lumberjacks use on a daily basis. For financial statements, tax liabilities, and equipment replacement plans to appropriately reflect the deterioration of these assets over time, depreciation of equipment must be taken into account.

-

Revenue Recognition: Revenue recognition in the forestry industry may be influenced by factors such as timber harvesting contracts, stumpage fees, and timber sales agreements. Lumberjacks may recognize money as they harvest and process trees over time, as opposed to at the time of sale, in contrast to standard sales transactions.

-

Seasonality: Demand, weather, and harvesting operations are all frequently impacted by seasonal variations in the forestry sector. To account for seasonal variations in revenue and expenses, accounting for lumberjacks may involve making adjustments to financial projections, budgeting, and cash flow management.

-

Environmental Aspects: When operating, lumberjacks need to take the conservation and sustainability of the environment into account. In order to appropriately account for environmental consequences, such as the costs associated with reforestation, habitat restoration, and carbon offset programmes, certain accounting techniques might be needed.

-

Risk management: The logging industry presents special risks to lumberjacks, such as equipment failures, worker safety issues, natural calamities, and changes in the market. Assessing and reducing these risks through insurance coverage, backup plans, and cash reserves are all part of accounting for risk management.

What accounting and bookkeeping services are offered by Accounts Junction?

A wide range of bookkeeping and accounting services are provided by Accounts Junction, specifically designed to satisfy the demands of lumberjacks in the forestry sector. The following are some of the main services that Accounts Junction offers to lumberjacks:

-

Income Tracking: Sales of wood products, logging services, and timber are just a few of the sources of income that Accounts Junction precisely tracks and classifies for lumberjacks. This guarantees accurate recording and accounting for all income in the financial records.

-

Expense Management: Accounts Junction keeps track of and oversees the costs of labor, gasoline, permits, insurance, and transportation in addition to equipment upkeep for lumberjack operations. By monitoring expenses, lumberjacks can identify cost-saving opportunities and ensure that expenses are within budgetary constraints.

-

Inventory Control: Accounts Junction helps lumberjacks keep track of the amount of harvested and processed wood products they have on hand. This entails monitoring the amounts, prices, and movements of inventory in addition to adjusting inventory levels to maximize client demand and reduce storage expenses.

-

Equipment Depreciation: By precisely documenting and monitoring the depreciation costs connected to their machinery and equipment, Accounts Junction assists lumberjacks in accounting for equipment depreciation. By doing this, the equipment's cost is guaranteed to be fairly distributed during its useful life and to be represented in the financial statements.

-

Work Costing: Lumberjacks can monitor the expenses related to individual logging or forestry projects by using Accounts Junction's work costing services. In order to help lumberjacks evaluate the profitability of their projects and make wise business decisions, this comprises labor costs, equipment utilization, materials, and administrative expenses.

-

Taxes: By preparing and filing tax forms, paying sales taxes (if applicable), and abiding by tax laws pertaining to business income, payroll, and equipment depreciation, Accounts Junction makes sure that lumberjacks comply with tax requirements. In doing so, lumberjacks are able to stay out of trouble with the tax authorities and avoid penalties.

-

Financial Reporting: For lumberjacks, Accounts Junction produces financial reports that include cash flow statements, balance sheets, and profit and loss statements. These reports give lumberjacks insightful information about the company's financial performance, which they can use to evaluate profitability, spot patterns, and formulate strategic plans.

Although generic accounting concepts offer a structure for managing finances in various businesses, lumberjack accounting necessitates specific knowledge and proficiency to tackle the distinct obstacles and factors present in the forestry and logging domain. Businesses may maximize their financial performance, guarantee regulatory compliance, and manage natural resources responsibly for future generations by comprehending and customizing accounting procedures to fit the unique requirements of lumberjacks.

Accounts Junction provides a full range of bookkeeping and accounting services aimed at helping lumberjacks in the forestry sector succeed financially. Lumberjacks may concentrate on their core business operations while maintaining accurate and compliant financial records by contracting with Accounts Junction to handle their bookkeeping and accounting needs.