May 11, 2024 Author: Accounts Junction

Mastering the Balance Sheet Reconciliation Process

Any organization that wants to make sure that its accounting records accurately represent its true financial status must undertake the balance sheet reconciliation process. A successful balance sheet reconciliation promotes regulatory compliance, stops financial misstatements, and helps in the early detection of anomalies.

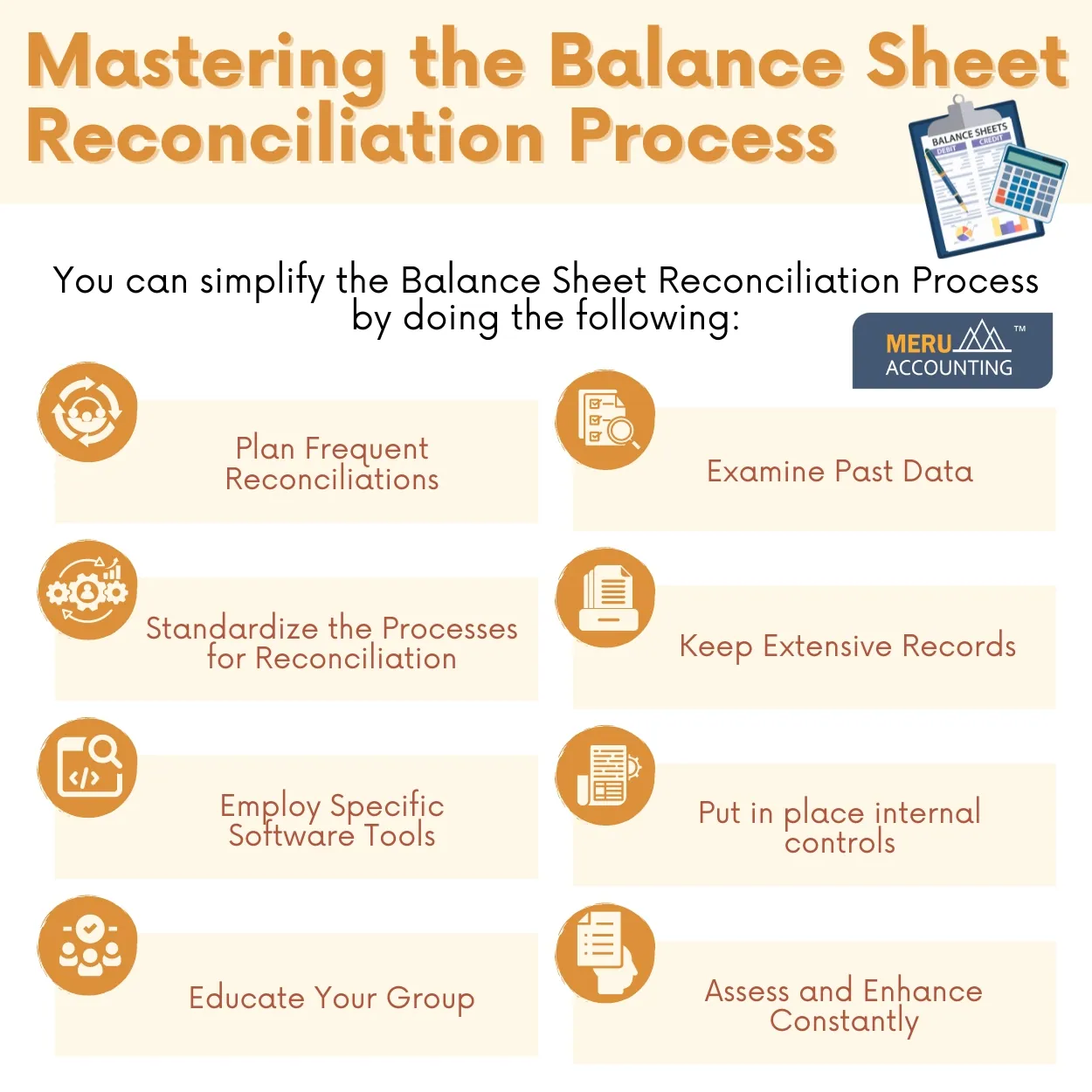

Simplifying the Process of Balance Sheet Reconciliation

To keep financial reporting honest, a strong balance sheet reconciliation process must be put in place. The following eight key points will help you improve the effectiveness and precision of your balance sheet reconciliation:

1. Plan Frequent Reconciliations: Usually done on a monthly or quarterly basis, perform balance sheet reconciliations on a frequent basis. Frequent evaluations assist in identifying and fixing mistakes early on, preventing problems from getting worse.

2. Standardize the Processes for Reconciliation: Create established protocols for the process of reconciling the balance sheet. Consistency in the handling of reconciliations across several accounts and departments is ensured by explicit guidelines.

3. Employ Specific Software Tools: Make use of specialized software meant for balance sheet reconciliation. These technologies can save time, cut down on human error, and automate a lot of the reconciliation process.

4. Educate Your Group: Make sure that each team member receiving training is qualified to work on the reconciliation process. The correctness of their work will increase if they comprehend the process and its significance.

5. Examine Past Data: Examine past reconciliation records to find recurrent problems or disparities. You can simplify reconciliations in the present and the future by being aware of historical trends.

6. Keep Extensive Records: Maintain thorough records of every reconciliation you carry out. Each item should be described, any differences should be explained, and a comment on how the discrepancies were fixed should be included.

7. Put in place internal controls: Put in place robust internal controls to stop financial reporting errors and fraud. Controls like job segregation and recurring internal audits are essential.

8. Assess and Enhance Constantly: Assess the efficiency of your balance sheet reconciliation process on a regular basis. Ask the team for input, and be willing to use new tools or techniques to improve the workflow.

Contact Accounts Junction if you are looking to outsource accounting services.